Keep Exploring

Related Posts

MHI CEO Responds to Washington Post Opinion Piece About Chassis Removal Legislation

MHI wrote a letter to the editor of the Washington Post in response to this opinion piece.

Newsweek Asks: Is This The $129,000 Solution to America’s Housing Crisis?

An article in Newsweek details how manufactured homes can help solve the housing crisis.

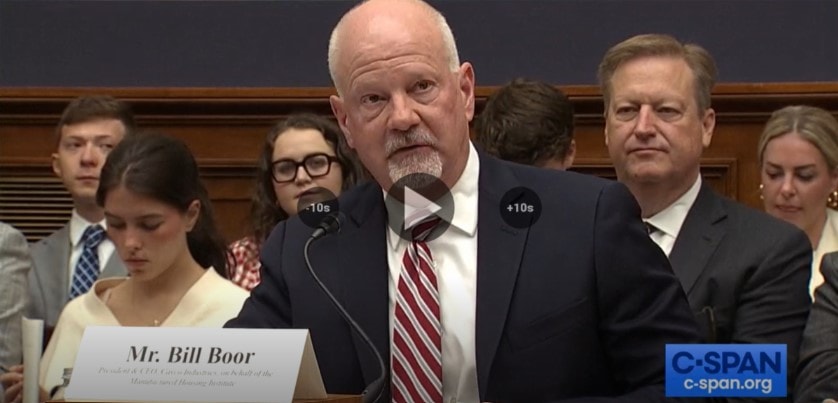

Housing Alert – MHI Vice Chairman to Congress: ‘E’ Should Not Be at the Expense of ‘S’

Boor called on Congress to pass H.R. 3327, the “Manufactured Housing Affordability and Energy Efficiency Act of 2023,” and highlighted the Department of Energy’s (DOE) Energy Conservation Standards for Manufactured Housing as an example of a federal agency implementing an environmental policy without fully understanding the broader consequences.

Implementation of HUD Code Updates Delayed

HUD has delayed the implementation of the HUD Code updates announced in September 2024. The new standards will be implemented Sept. 15, 2025.

Navigating the 2024 Political Landscape with MHI

To help our members stay on top of the ever-evolving political landscape, MHI has collaborated with National Journal to provide timely, topical summaries of recent headline items.

White House Proposes 5% Cap on Rent Increases

On Tuesday, President Biden proposed a five percent cap on rent increases as a part of his efforts to lower housing costs. The proposal, which would require Congressional approval, would deny the ability of landlords to utilize depreciation tax benefits if they increase rents by more than 5%.